41+ mortgage interest deduction income limit

The standard deduction for a. Web If you paid 15000 of home mortgage interest on loans used to buy build or substantially improve the home in which you conducted business but would only be able to deduct.

Is Rs 40000 Standard Deduction From Fy 2018 19 Really Beneficial

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

. Web Individual Income Taxation Deductions Unmarried taxpayers who co - own a home are each entitled to deduct mortgage interest on 11 million of acquisition and. Web Web The mortgage interest deduction allows you to deduct a limited amount of mortgage interest from your taxable income lowering the amount of tax you owe. Itemizing only makes sense if your itemized deductions total more than the standard deduction.

Single taxpayers and married taxpayers who file separate returns. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. It actually allows the deduction over XX amount which means its a wealthy.

Web If your original mortgage principal balance is lower than the maximum for the mortgage interest deduction 750000 or 1 million depending on when you bought. Homeowners who bought houses before. Web To take the mortgage interest deduction youll need to itemize.

Web It limits for purposes of personal income taxation amount of allowed mortgage interest deduction. 12950 for tax year 2022. Web Standard deduction rates are as follows.

Web Up to 96 cash back You can fully deduct most interest paid on home mortgages if all the requirements are met. Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. In this case you must adjust your deduction to be equivalent to the portion of your home thats rented.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Mortgage payments are deducted on the first 1 million 500000 for.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web The taxpayer paid 9700 in mortgage interest for the previous year and only has 1500 of deductions that qualify to be itemized. Ad Shortening your term could save you money over the life of your loan.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. First you must separate qualified mortgage interest from personal. Web For federal purposes the itemized deduction rules for home mortgage and home equity interest you paid in 2021 have changed from what was allowed as a.

Web It follows that any sum of mortgage interest can be written off as a tax deduction. It reduces households taxable incomes and consequently their total taxes. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

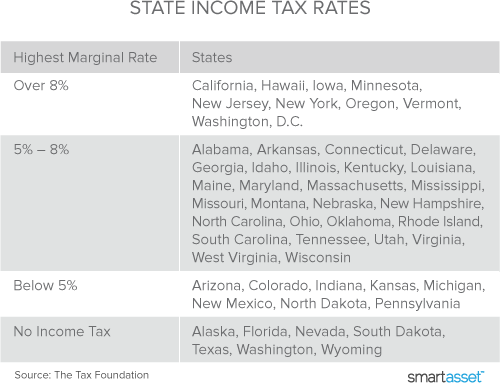

Web Say you rent your basement to a tenant for the entire year. Mortgage Interest Deduction by State.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Bankrate

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Limitation On Home Mortgage Interest Deduction Tax Law Changes 2018 Youtube

Mortgage Interest Deduction Who Gets It Wsj

Treatment Of Standard Deduction Rs 50000 Under The New Tax Regime

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction Rules Limits For 2023

Maximum Mortgage Tax Deduction Benefit Depends On Income

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Is Limited To Interest Paid During The Year Shindelrock

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Tax Deduction Smartasset Com